More information on import declaration procedures and import restrictions can be found at the Malaysian Customs. Calculations RM Rate TaxRM 0 - 5000.

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Every country is.

. Taxable Income RM 2016 Tax Rate 0 - 5000. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

De minimis rate is the price threshold below which fewer or no taxes are charged on shipments entering the country. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. You need to be aware of the following.

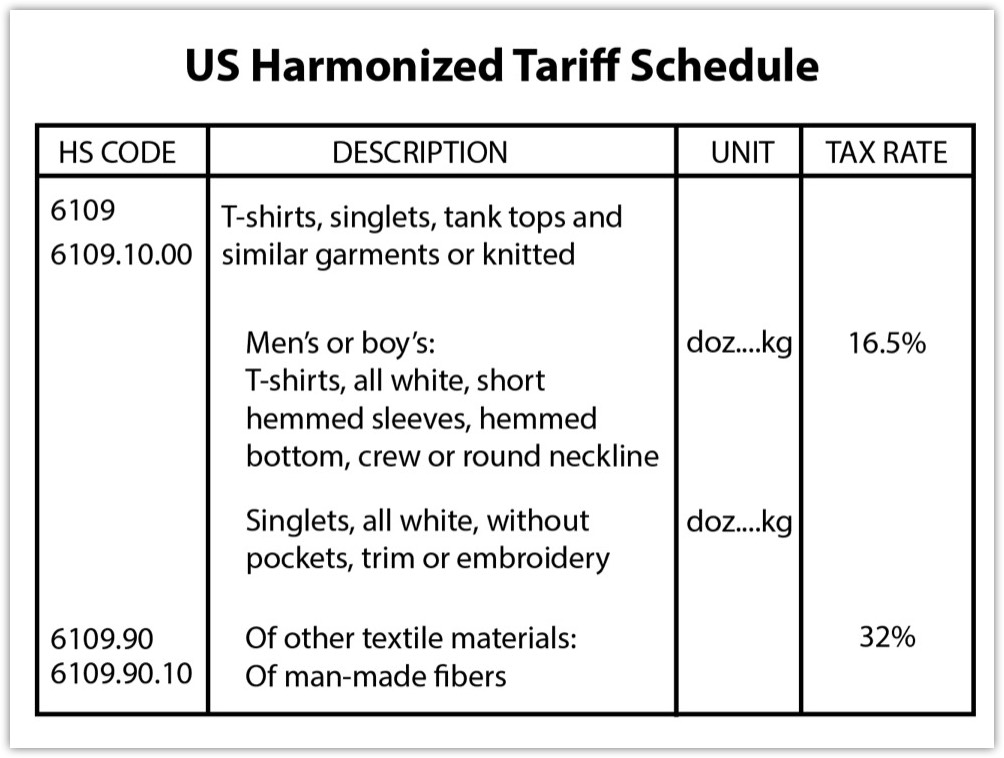

AFTA Malaysia intends to eliminate import duties on all products and thereby realize AFTAs ultimate target of creating an integrated market with free flow of goods within the region. Estimate your tax and duties when shipping from United States to Malaysia based on your shipment weight value and product type. Includes information on average tariff rates and types that US.

Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. In Malaysia the de minimis rate is MYR 500 or roughly USD 115 as of the time of this writing. Malaysia - Import TariffsMalaysia.

Based on the tax rate table above RM25000 would be taxed RM150 on the first RM20000 and RM250 on the remaining RM5000 which brings it up to about RM400 in tax. On the First 2500. Check out our free calculator to get an instant estimate.

The Goods and Service Tax GST has been repealed and the old Sales and Service Taxation SST with possible modification will commence in 2018. Rate TaxRM A. The Sales Tax Rates of Tax No2 Order 2008 came into force also on 1 April 2008.

Up to 128 cash back Want visibility on duties and taxes when shipping from Malaysia to Malaysia. 5001 - 20000. Exports and imports of products by stages of processing in 2016 are below along with their corresponding Product Share as percent of total export or import.

Shipping Rates Based On. Tariff quotas in 57. The term de minimis comes from a longer.

Assessment Year 2016 2017 Chargeable Income. Egg in the shells. Income attributable to a Labuan.

Corporate tax rate of 24 effective. Live animals-primates including ape monkey lemur galago potto and others. Your shipment may be subject to a custom duty and import tax.

Malaysia Raw materials imports were worth US 14038 million product share of 834. Malaysia Part A1 Tariffs and imports. Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased by 3.

The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary paid-. Malaysia tariff rates for 2014 was 128 a 316 decline from 2013.

Trying to get tariff data. On the First 5000. GST was only introduced in April 2015.

More information on import declaration procedures and import restrictions can. The Ministry of Finance announced on. Start Shipping To Malaysia With.

In Malaysia 2016 Reach relevance and reliability. Summary and duty ranges Total Ag Non-Ag WTO member since 1995 Simple average final bound 209 536 149 Total 843 Simple average MFN applied 2020 57 87 52 Non-Ag 819 Trade weighted average 2019 39 86 35 Ag. Malaysia Raw materials exports were worth US 11159 million product share of 589.

Last published date. When the effectively applied rate is unavailable the most favored nation rate is used instead. The Goods and Service Tax GST has been repealed and the old Sales and Service Taxation SST with possible modification will commence in September 2018.

Malaysia Taxation and Investment 2016 Updated November 2016. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an. YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary.

Start Shipping To Malaysia With Confidence. 20001 - 35000. Malaysia tariff rates for 2013 was 444 a 003 increase from 2012.

Up to 128 cash back Duties Taxes Calculator to Malaysia. Your Chargeable Income RM4044944 RM9000 RM2000 RM449444 RM25000. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities.

Every country is different and to ship to Malaysia you need to be aware of the following. Malaysia is having a three months GST free holiday from June-August 2018. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia.

June 2015 Produced in conjunction with the. Sales tax in Malaysia is a single-stage tax imposed at the manufactures level. Malaysia tariff rates for 2016 was 402 a 274 increase from 2014.

For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope.

This rate takes into account the value of the shipped goods and the shipping fees. On the First 5000 Next 15000. Firms should be aware of when exporting to the market.

Facilities Under The Sales Tax Act 1972. In the case of locally manufactured taxable goods sales tax is levied and charge on the finished goods when such finished goods are. Merchandise Trade summary statistics data for Malaysia MYS including exports and imports applied tariffs top export and import by partner countries and top exportedimported product groups along with development indicators from WDI such as GDP GNI per capita trade balance and trade as percentage of GDP for year 2016.

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. May be subject to a custom duty and import tax.

SST is administered by the Royal Malaysian Customs Department RMCD.

Doing Business In The United States Federal Tax Issues Pwc

Where Tariffs Are Highest And Lowest Around The World Infographic

Tonga Sales Tax Rate 2021 Data 2022 Forecast 2014 2020 Historical Chart News

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

What Is The Difference Between Taxes Duties And Tariffs Trg

France S 8 Effective Tax Rate Only For Small And Very Big Firms

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

The Impact Of Tax Hikes On Stocks Nasdaq

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Carbon Taxes Worldwide By Select Country 2021 Statista

France S 8 Effective Tax Rate Only For Small And Very Big Firms

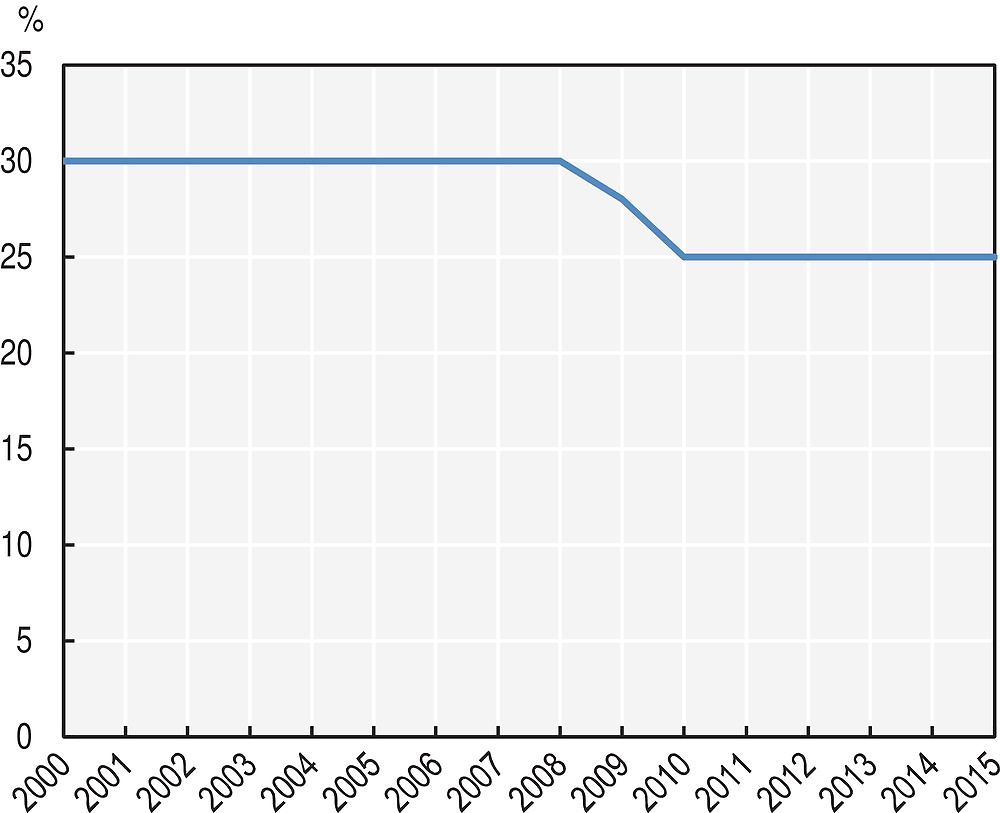

Cross Country Comparison Of Taxation In Agriculture Taxation In Agriculture Oecd Ilibrary

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

Eritrea Sales Tax Rate Vat 2021 Data 2022 Forecast 2014 2020 Historical

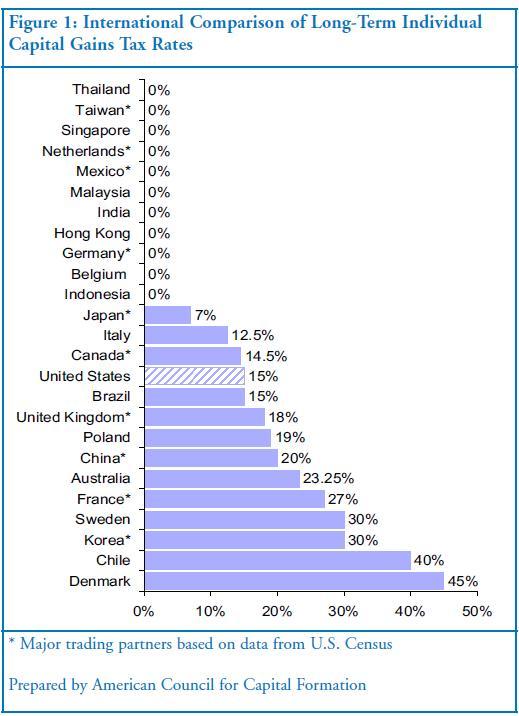

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Update On Anti Dumping For Some Monosodium Glutamate Msg Food Additives Food To Make Asian Cuisine